DOGE Price Prediction: Can ETF Momentum and Treasury Support Drive Towards $1?

#DOGE

- Technical indicators show DOGE testing support near lower Bollinger Band with mixed momentum signals

- ETF proposals and $175M+ treasury allocations creating strong fundamental support

- Reaching $1 requires 370% growth dependent on broader market adoption and sustained institutional interest

DOGE Price Prediction

Technical Analysis: DOGE Shows Mixed Signals Near Key Support

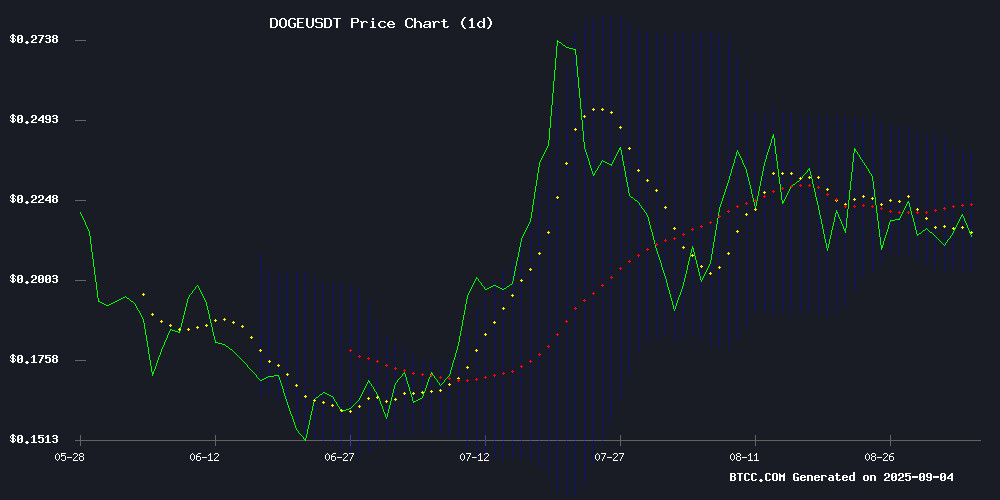

DOGE is currently trading at $0.21335, below its 20-day moving average of $0.220851, indicating short-term bearish pressure. The MACD reading of -0.000474 suggests weakening momentum, though the difference between MACD and signal line remains relatively small. Price action NEAR the lower Bollinger Band at $0.202531 could indicate potential support testing. According to BTCC financial analyst Olivia, 'DOGE needs to reclaim the $0.22 level to shift the short-term momentum bullish.'

Market Sentiment: ETF Buzz and Treasury Initiatives Fuel Optimism

Positive news FLOW surrounding potential ETF developments and treasury allocations is creating bullish sentiment despite current technical weakness. The $175M treasury allocation and REX-Osprey's ETF proposal are generating institutional interest, while Elon Musk's lawyer backing the $200M treasury initiative adds credibility. BTCC financial analyst Olivia notes, 'These fundamental developments could override short-term technical resistance if adoption momentum continues.'

Factors Influencing DOGE's Price

Dogecoin (DOGE) Price Prediction: ETF Buzz and Treasury Formation Signal Potential Breakout

Dogecoin is showing renewed strength after months of consolidation near the $0.20 support level. A combination of bullish catalysts—including the first U.S. Dogecoin ETF filing, a $175 million corporate treasury initiative, and surging trading volume—suggests the memecoin may be poised for its next major rally.

REX-Osprey's filing with the SEC for a Dogecoin ETF (ticker: DOJE) marks a watershed moment for memecoin legitimacy. The fund plans to allocate at least 80% of assets to DOGE or related derivatives, offering institutional investors regulated exposure without direct token ownership. Market observers see this as a potential gateway for mainstream capital inflows.

Technical charts reveal an emerging bullish structure with higher highs and lows. DOGE currently trades at $0.22, reflecting an 11% monthly gain and 122% year-over-year increase despite a 30% YTD drawdown. The confluence of fundamental developments and technical strength has traders anticipating upside momentum.

Dogecoin Stalls Below $0.22 as Remittix Presale Gains Whale Interest

Dogecoin's price remains trapped below the $0.22 resistance level, trading at $0.212 amid persistent selling pressure. Bulls face frustration as the meme coin struggles to break out of a weeks-long consolidation pattern, with on-chain data revealing sustained whale outflows that dampen upward momentum.

Meanwhile, Remittix emerges as a focal point for institutional capital, raising over $23 million in its presale with 640 million tokens sold. The project's real-world payment utility and growth potential are drawing sharp contrast to Dogecoin's speculative hype, positioning it as a favored alternative among sophisticated investors.

Technical analysis shows Dogecoin compressing within a descending channel, though historical accumulation patterns suggest potential for future bullish cycles. Market participants remain divided between near-term downside risks and long-term breakout possibilities, with the $0.21 support level becoming increasingly critical for maintaining current valuation floors.

Dogecoin Price Targets $1 After $175M Treasury Allocation

Dogecoin's price trajectory is drawing bullish attention following CleanCore Solutions' commitment of $175 million to a DOGE treasury fund. The meme coin held steady above $0.20, with technical analysts eyeing a potential breakout above $0.245 that could propel it toward $0.38 or beyond.

Market observers note Dogecoin's adherence to a long-term logarithmic uptrend—a pattern historically associated with explosive rallies. Bitcoinconsensus researchers highlight the token's consolidation phase, suggesting an impending directional move. Momentum indicators like the RSI and MACD further support this outlook, with the latter's flattening often preceding volatility.

While whale activity remains subdued, retail traders appear poised to drive the next leg up. Some forecasts extend as high as $1.40, though the path hinges on sustained corporate adoption and broader crypto market sentiment.

REX-Osprey's Dogecoin ETF Proposal Fuels $DOGE Rally as Maxi Doge Presale Gains Momentum

Dogecoin surged 2.68% following REX-Osprey's teaser of a potential Dogecoin ETF, with the firm committing to allocate 80% of assets to $DOGE and related derivatives. The memecoin has gained 126.62% year-to-date as institutional interest grows.

The Maxi Doge presale approaches $2 million amid the ETF speculation, signaling renewed retail enthusiasm. Regulatory tailwinds including Trump's GENIUS Act—mandating issuer transparency and anti-fraud measures—are creating a favorable environment for crypto adoption.

REX-Osprey's strategic move capitalizes on this regulatory shift, potentially accelerating mainstream acceptance. Market observers note the announcement's deliberate timing, with the X (formerly Twitter) disclosure sparking immediate price action.

Dogecoin Stabilizes at $0.22 as Technical Pattern Hints at $0.30 Breakout

Dogecoin (DOGE) has found equilibrium at $0.22 after a week of volatility, with a emerging cup-and-handle pattern suggesting a potential rally toward $0.30. The meme coin's price action reflects a tug-of-war between bullish technicals and bearish whale activity.

On August 29, DOGE dropped 5% following a whale's transfer of 900 million tokens to Binance, breaching the $0.22 support level. This sell pressure was countered by a rebound from $0.21 on August 31, creating the current consolidation zone. The cup-and-handle formation now points to upside potential, though whale movements remain a wildcard for short-term momentum.

Dogecoin Shows Mixed Signals as Volume Spikes Amid Resistance Test

Dogecoin gained 4% in a 24-hour session, climbing from $0.216 to $0.218, but faced strong rejection at $0.223 with trading volumes surging to 416.41 million tokens—far exceeding the daily average. Institutional interest appears to be growing as prediction markets now price ETF approval odds at 71%, up from 51%.

Technical patterns suggest a brewing battle between bulls and bears. The formation of lower highs and expanding volume on declines points to distribution, while some analysts see a potential triangle breakdown targeting $0.17 Fibonacci support. Others maintain ambitious $1.00-$1.40 upside targets based on historical pattern repetitions.

Key levels to watch include established support at $0.214 and resistance at $0.223, where high-volume rejection occurred. The midday rally from $0.215 to $0.219 on 400M+ volume spikes showed institutional participation before profit-taking emerged.

Elon Musk’s Lawyer Alex Spiro Backs $200M Dogecoin Treasury Initiative

Alex Spiro, renowned as Elon Musk's personal attorney, has taken a pivotal role in the cryptocurrency space by chairing a $175–200 million Dogecoin treasury project. The initiative, spearheaded by CleanCore Solutions and the Dogecoin Foundation's corporate arm, House of Doge, aims to establish DOGE as a reserve asset, marking a significant step toward institutional adoption.

CleanCore Solutions will raise approximately $175 million through a private placement, with proceeds allocated to purchasing Dogecoin. The offering has garnered support from over 80 institutional investors, including Pantera, GSR, and FalconX. Swiss firm 21Shares, managing $12 billion in assets, will advise on strategic allocation and governance, ensuring the treasury meets institutional standards.

Spiro's involvement lends credibility to the project, reflecting growing mainstream interest in meme coins. The move signals Dogecoin's evolving role beyond internet culture into structured financial instruments.

Will DOGE Price Hit 1?

While current technical indicators show DOGE facing resistance near $0.22, the fundamental developments present a compelling case for long-term growth. The combination of ETF speculation, significant treasury allocations ($175M+), and high-profile backing creates strong underlying support. However, reaching $1 would require approximately a 370% increase from current levels, which likely depends on broader crypto market adoption and sustained institutional interest. BTCC financial analyst Olivia suggests that while $1 is possible in a bullish scenario, investors should monitor key resistance levels and fundamental developments closely.

| Key Levels | Price | Significance |

|---|---|---|

| Current Price | $0.213 | Testing support |

| 20-day MA | $0.221 | Immediate resistance |

| Upper Bollinger | $0.239 | Breakout level |

| Target | $1.000 | Long-term goal |